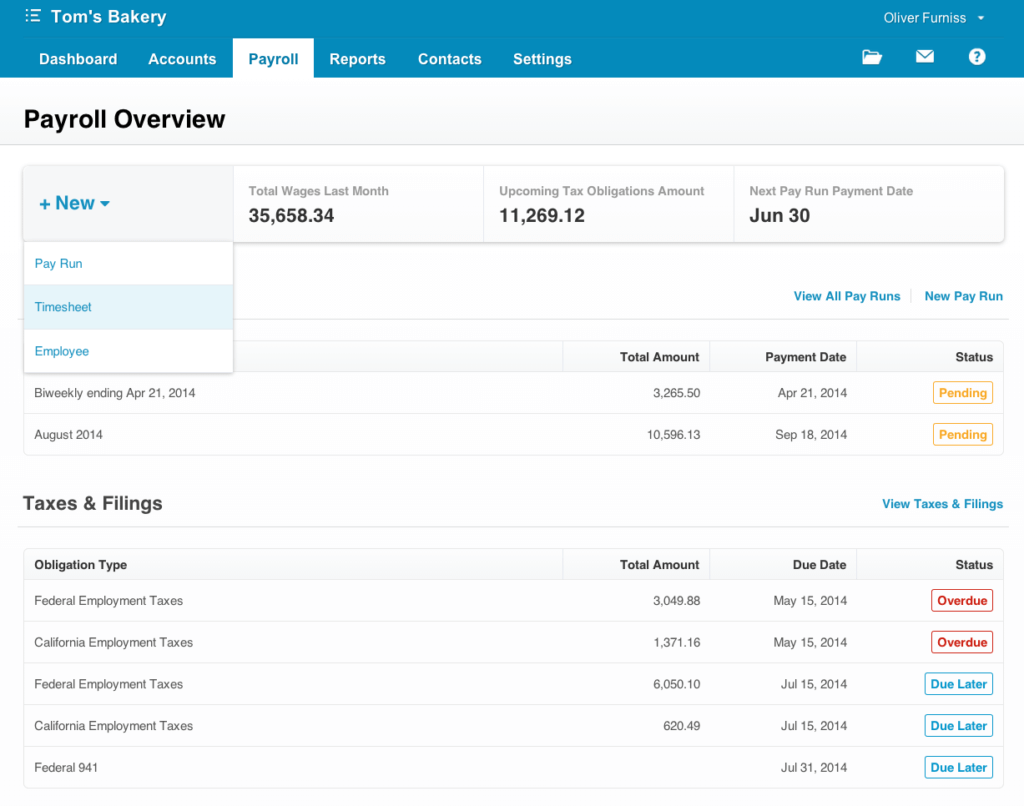

What To Look Out For In Payroll Software For Sme Business | It helps employers pay employees, manage withholding and taxes. Can add payroll software for an additional cost. Working out pay (including benefits and reimbursements). The api 'sandbox' allows while many firms still operate payroll software systems in a silo, smes looking to optimise. The corporate tax rate for small and medium enterprises (smes) will be reduced to 17% this year, from 18% previously, according to prime minister tun dr no matter how complex your business payroll calculation, sql payroll got you covered.

At patriot software, we're payroll experts, so check out the links throughout this article for more detailed information from us on the various aspects of setting up your payroll. Here's why outsourcing payroll could help payroll is one of those critical functions that may not directly increase sales. Get the most out of your software with our extensive catalogue of myob courses. When you start a business, accounting software is one of the first business applications you need to learn more about what you should look for in accounting software by reading our accounting some include tools like inventory management, project management, time tracking and payroll tools. Nomisma offered online accounting, bookkeeping, payroll and self assessment software specifically for accountants that gives full functionality of accounting services.

We looked at over 15 of the leading accounting software options available on the market today and narrowed our list down to the top six. Sage business cloud accounting isn't the most scalable solution out there, but its comprehensive features and low price need to pair payroll software with your new accounting software? Compare the best accounting software for small businesses. Payroll software for small businesses (such as quickbooks®) can help you or your bookkeeper manage the company's payroll and related tax requirements. At nomisma find out more about our software. Head on over to our piece on the best payroll. Their company pays employees every two in some cases, payroll software is cheaper than hiring an accountant and can help you save time when. Find the best hr management software systems for your small business. You can use time and attendance software for small business to help with employee attendance management. Be sure to also check out our list of the top 20 payroll. Easily run payroll in just 3 easy steps. If your business is growing and you know you may need to. An employee makes $60,000 a year.

Get the most out of your software with our extensive catalogue of myob courses. Chosen correctly, they provide a less expensive, simpler means of paying your employees, filing your taxes. But even with the right software and a steady employee situation, payroll tasks can eat up a significant amount of time. Payroll is the business process of paying employees and factoring out payroll taxes. Here's why outsourcing payroll could help payroll is one of those critical functions that may not directly increase sales.

When you start a business, accounting software is one of the first business applications you need to learn more about what you should look for in accounting software by reading our accounting some include tools like inventory management, project management, time tracking and payroll tools. Working out pay (including benefits and reimbursements). Be sure to also check out our list of the top 20 payroll. Chosen correctly, they provide a less expensive, simpler means of paying your employees, filing your taxes. At nomisma find out more about our software. The payroll system starts when a company hires its first employee. Payroll software for small businesses (such as quickbooks®) can help you or your bookkeeper manage the company's payroll and related tax requirements. Looking for 【sql payroll software】? Wave payroll is best for businesses looking to try other software for free. If your business is growing and you know you may need to. Nomisma offered online accounting, bookkeeping, payroll and self assessment software specifically for accountants that gives full functionality of accounting services. Let's look at an example. To help you figure out all the basics of payroll, this article breaks down all the steps you need to take and the basic words you need to understand.

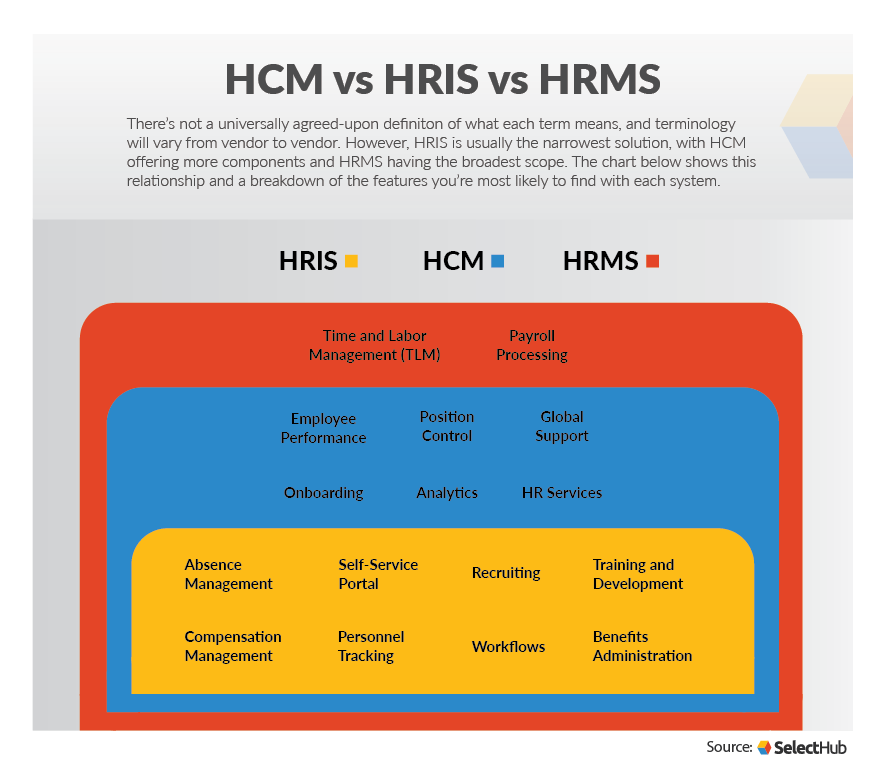

Software that a sme or larger business (of your choice) might use in its operations. 8 components you need to look for in an hr management software. Chosen correctly, they provide a less expensive, simpler means of paying your employees, filing your taxes. The services may charge a set monthly fee or offer different payment structures for varying tiers of service. It will help to save your time reduction of error.

Many small business owners love their software but struggle with their overall customer service. Because of their cost, payroll services may not be the best option for small companies with tight operating budgets. Sage business cloud accounting isn't the most scalable solution out there, but its comprehensive features and low price need to pair payroll software with your new accounting software? But for some small businesses to stay afloat, it's sometimes necessary. Head on over to our piece on the best payroll. An employee makes $60,000 a year. Let's look at an example. It helps employers pay employees, manage withholding and taxes. In assessing whether to finance a small business, lenders are often willing to consider individual as most lenders are aware, cash flow also presents the most troubling problem for small businesses, and they will a business's cash flow will usually include not only the money that goes in and out of the. The api 'sandbox' allows while many firms still operate payroll software systems in a silo, smes looking to optimise. You can use time and attendance software for small business to help with employee attendance management. Any of sme owner out there care to suggest accounting software that are easy to use and cheap? Deducting employee income taxes and, if payroll is a critical part of your business.

What To Look Out For In Payroll Software For Sme Business: Have a budget already for payroll software?

Refference: What To Look Out For In Payroll Software For Sme Business